Climate Insurance Innovation

We are redefining the way climate and disaster risk financing is actively managed through Smart Index Insurance solutions. By leveraging cutting edge tech, we are committed to provide a proactive, data driven methodology to create versatile products for Governments, Multilateral Development Agencies, (Re)Insurers, and Intermediaries.

Smart Index Insurance Products

A tailored plan that delivers rapid, transparent protection ensuring quick payouts for the specific risks that you choose.

Focus Areas

Innovation and research form our foundation, enabling us to build transformative and impactful solutions

Climate Analytics

Advanced Insurtech solutions

Our solutions factor in multidecadal trends, ENSO, IOD, and other global climate drivers to address diverse environmental risks.

Geospatial Models

From India to the Globe

Covering every state, district, sub-district, gram panchayat, village, and pincode. Built in India, for the World.

Research Collaboration

With Global Institutes

Collaborating with premier global research institutes to drive innovation and deliver transformative climate resilience solutions.

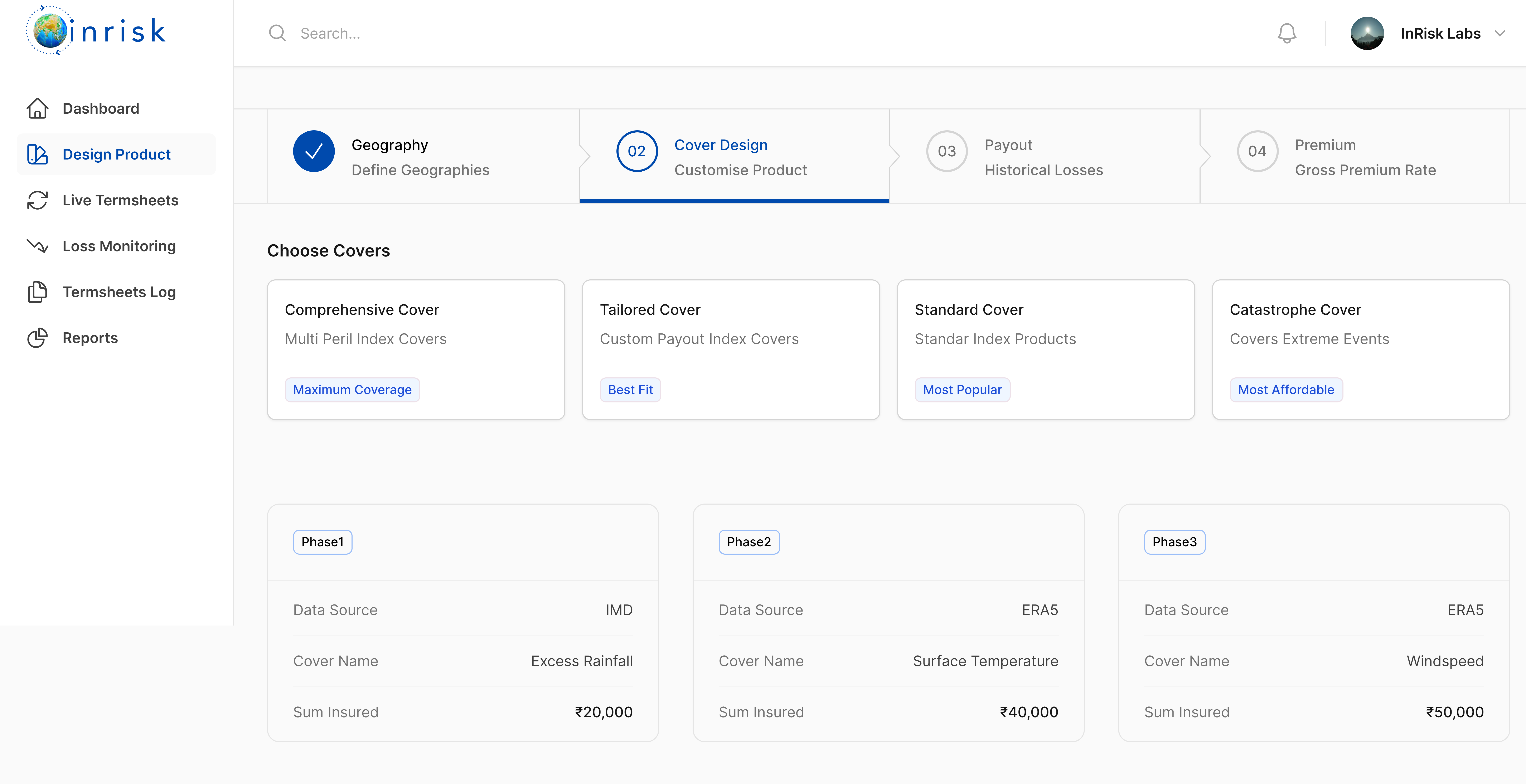

Build Products Instantly

Innovative platform offering real-time product customisation, smart AI-based pricing, and continuous claims monitoring for efficient and responsive insurance solutions.

- Build your own Product.

- Embrace the agility and efficiency of real-time, customisable products to adapt swiftly to changing risks and customer needs.

- Dynamic Pricing Models.

- AI-driven dynamic pricing models offer risk-adjusted, accurate premium, leveraging advanced algorithms at lightning speed.

- Real-time Monitoring.

- Real-time monitoring to continuously tracks parameters, instantly triggering notifications for claims based on precise, predefined conditions.

Smart Index Insurance

We empower index risk management by integrating data analytics, AI-driven pricing algorithms, interactive dashboards, and blockchain technology to ensure efficiency, transparency, and scalability

- Product Design

- We engage with intermediaries and clients to customise index insurance, and shape robust strategies for comprehensive risk management

- Risk Contours

- We utilize institutional-grade data from sources like IMD, NASA, ESA, and research organisations for defining risk contours

- Pricing

- Our AI-driven pricing engine analyses data with thousands of variables for fast and reliable premium quotations

- Underwriting Partnerships

- We partner with leading insurers and reinsurers to facilitate underwriting capacity for products developed and designed through InRisk

- Claims Monitoring

- Real-time monitoring of data, triggers, and claims made available to clients, intermediaries, insurers, and reinsurers

- Smart Contracts

- We use blockchain technology for contract automation, enhancing efficiency and transparency in coverage processes

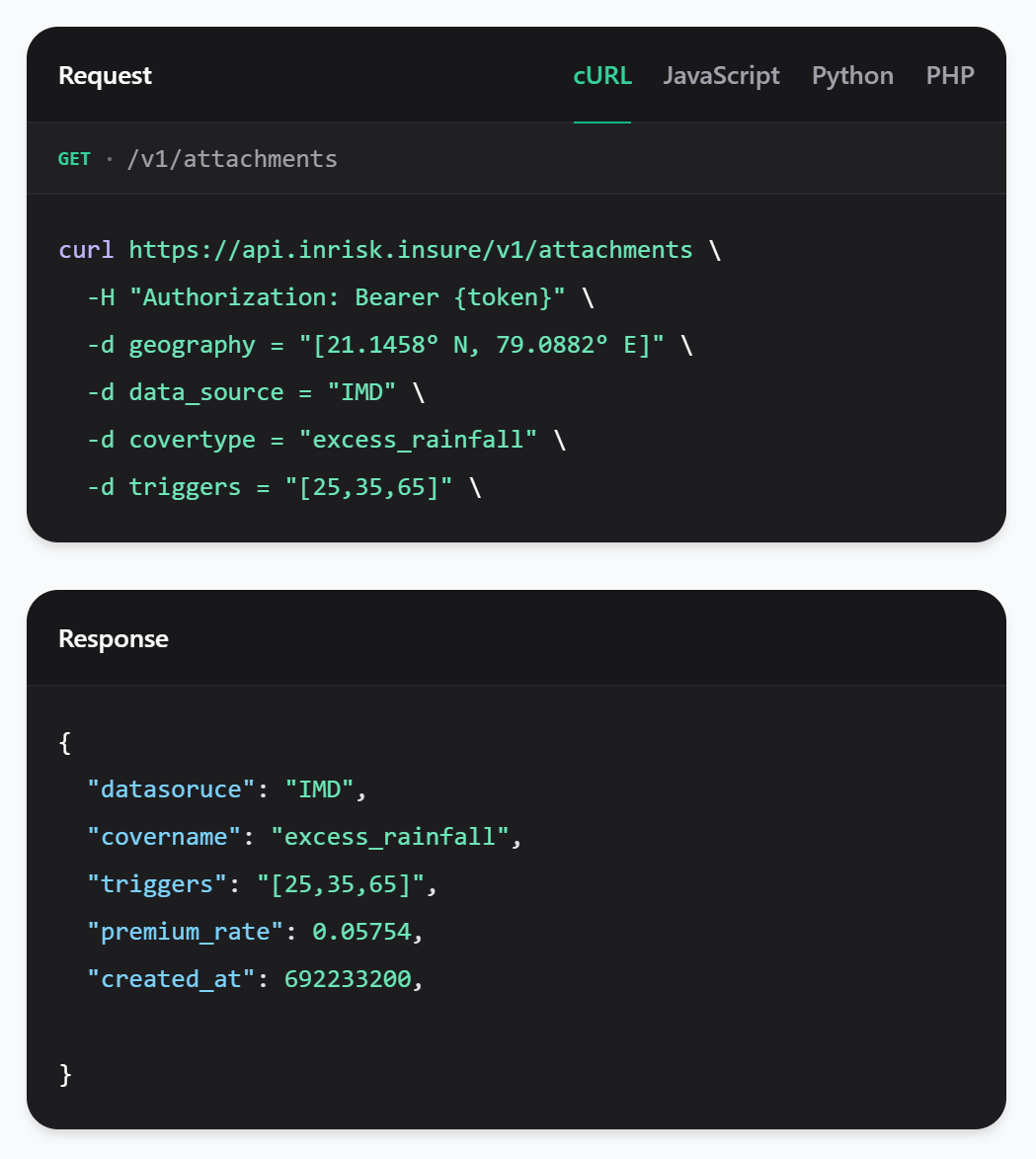

API Integration for Partners

Insurance partners can seamlessly integrate our API onto their applications for enhanced, customized insurance service offerings.

Always in the loop

Insurance products can be easily and efficiently priced using our API, streamlining the entire lifecycle.

API on-demand

- Advanced API on-demand featuring dynamic, sophisticated pricing models,ensuring accuracy and efficiency.

Easy Integration

- Utilize our advanced API effortlessly on your infrastructure, ensuring seamless integration without major changes.

Real-time Analytics

- Access real-time analytics to monitor for data-driven decisions to enhance experience and operational efficiency

Latest stories

Insights, perspectives, and research from our team on climate risk, parametric insurance, data science, and the future of risk transfer.

Our Team

We’re a dynamic group of individuals who are passionate about what we do

Aavrit Singhal

LinkedInChief Product Officer

With over a decade of experience in non-life and agriculture insurance marketing, his expertise spans strategic policy, business development, and product management, with a knack for addressing intricate insurance challenges

Akshay Kumar

LinkedInAnalyst - Software Development

Full Stack specialist with cloud-native experience, he designs automated ETL data pipelines and scalable services on GCP for real-time claims monitoring dashboards and workflows using Python, BigQuery, Cloud Run, Firebase, and Next.js

Hitarthi Mer

LinkedInActuarial Analyst

Working in parametric insurance pricing, and trigger design. She integrates actuarial models and statistical methods with technology-driven data systems to build transparent, data-driven insurance solutions

Malay Kumar Poddar

LinkedInManaging Director

Former Chairman and Managing Director of one of the largest crop insurance companies in the world, he has played a pivotal role in reshaping the landscape of Indian crop and rural insurance

Paras Jain

LinkedInProduct Associate

With experience across life and non-life insurance, he drives parametric insurance product innovation, pricing, and risk modelling in close collaboration with insurance companies and key stakeholders

ShivaKhumar R S

LinkedInChief Technology Officer

Leading Data Scientist with experience in machine learning and deep learning frameworks, he has expertise in translating complex challenges in insurance into structured analytic frameworks and generating actionable insights

Shreetu Nandi

LinkedInActuarial Analyst

Working on natural catastrophe and climate modelling, she supports pricing and actuarial analysis while driving actionable business insights and enabling informed decision-making for parametric insurance products

Siddesh Ramasubramanian

LinkedInChief Executive Officer

Having headed the Actuarial, R&D and Emerging Markets verticals of one of the largest crop insurance companies in the world, he has pioneered innovative end-to-end insurance solutions benefitting millions of customers

Frequently Asked Questions

If you have anything else you want to ask, reach out to us.

What is Index Insurance?

Index Insurance offers pre-determined claims for specific defined events with a given intensity, streamlining the claims process

Why choose InRisk for Index Insurance Solutions?

InRisk innovates Index Insurance with data-driven frameworks, ensuring maximum value and tailored products for clients

How does InRisk operate? Is it a broker/intermediary?

InRisk is an insurtech company which partners with intermediaries and (re)insurers offering them customized index insurance products and solutions

How long does it take for an Index Insurance product to be developed?

Index Insurance product can be developed instantly using InRisk's proprietary product configuration tool by simply providing risk contours

What are the advantages of Index Insurance?

Index Insurance ensures transparency, rapid claim settlements, reduced operational costs, scalability, and easy tech integration

How is Index Insurance different from Traditional Insurance?

Index Insurance has a preset benefit structure, unlike traditional insurance where claim surveys, deductibles, exclusions and sub-limits apply

How is basis risk reduced by InRisk’s Smart Index Insurance solutions?

InRisk minimizes basis risk with thorough research and AI/ML tools, effectively bridging the gap between actual and insured losses

How long does it take to compute and finalise the claims ?

The InRisk platform's real-time claim monitoring capability guarantees that claims are processed instantly following the update of source data

What can be covered under Index Insurance?

It covers a wide range, including economic losses without damage, loss of profits, increased working costs, and small-scale risks

Can Index Insurance replace Indemnity-based Insurance?

No, Index Insurance complements traditional insurance, enhancing coverage but not replacing indemnity-based policies

What are the considerations while designing Index Insurance solutions?

Index Insurance Products must ensure data sources and parameters accurately reflect losses and are readily accessible

What additional business insights are offered by InRisk?

InRisk can provide early warnings for claims by analyzing data trends allowing our partners to prepare for potential claims more effectively

Reach Out to Us

Want to visit our office or speak with us?