From Complexity to Clarity: How Parametric Insurance Simplifies Climate Risk Management

Turning climate extremes into predictable financial responses through clear rules and automated execution.

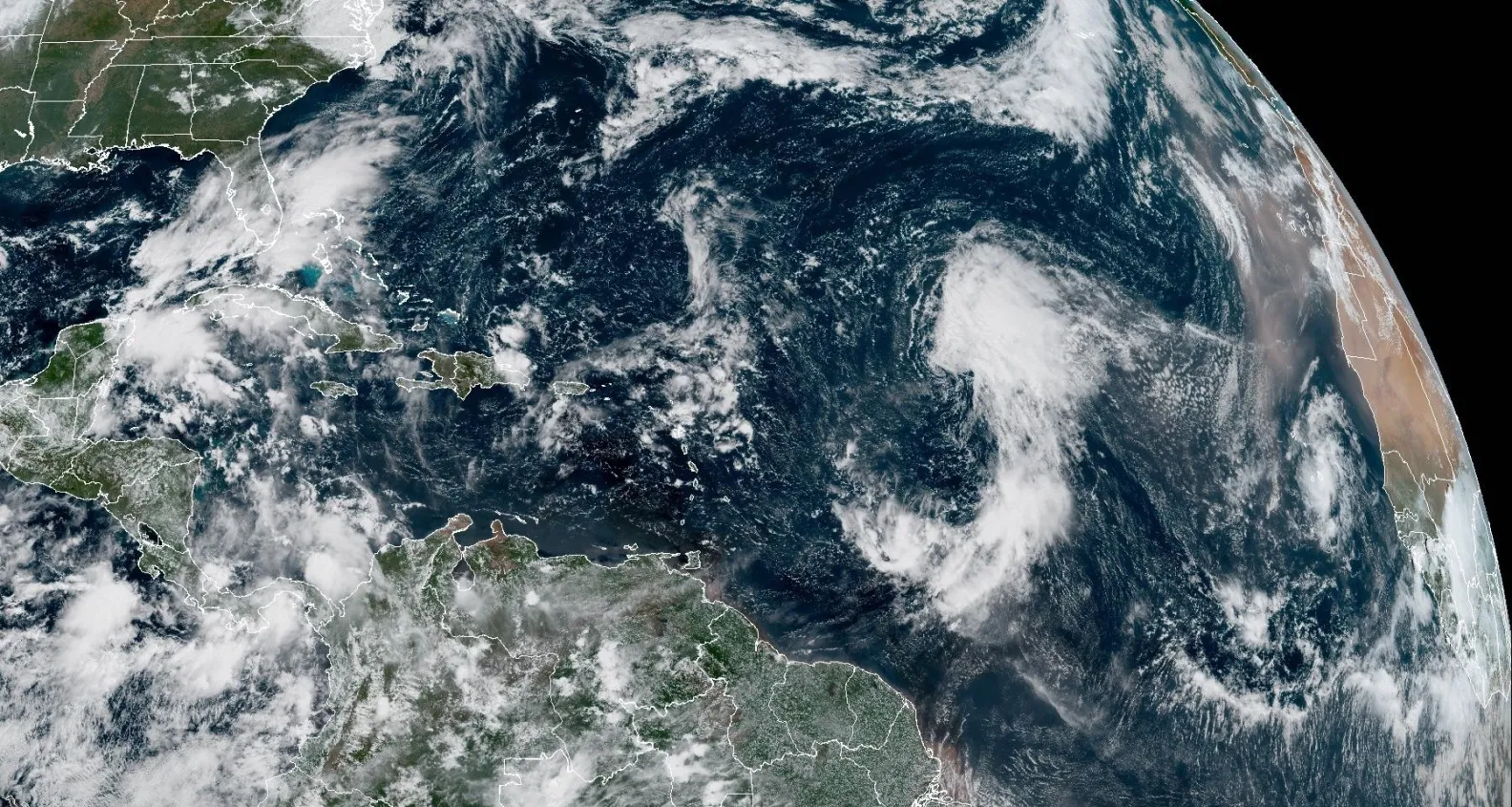

Every year now brings a new set of broken climate records. Heatwaves last longer, rain arrives in violent bursts, and coastal storms redraw maps overnight. Climate change is no longer a distant warning; it is an operating reality.

But climate change is not only a story about unstable weather. It is, increasingly, a story about money. Heatwaves eat into labour productivity and power demand. Floods disrupt supply chains and erode asset values. Droughts and erratic rainfall ripple through food prices and farm incomes, while coastal storms quietly reprice real estate and infrastructure. What begins as a physical shock is quickly translated into credit risk, market risk and, ultimately, fiscal pressure on governments trying to respond after the fact.

Physical Shock

Heatwaves, Floods, Droughts, and Storms.

Financial Translation

Credit risk, Market risk, and Fiscal pressure on governments.

In 2024 alone, natural disasters generated roughly US$320 billion in economic losses worldwide, with only about US$140 billion insured – leaving close to 60% of losses on the balance sheets of households, firms and governments.

Climate Volatility: A Material Financial Risk

Boards and policymakers are starting to realise that climate risk is not a separate category to be parked in a sustainability report; it is embedded in revenue stability, cost structures and the resilience of balance sheets. Climate volatility has become a material financial risk, and it shows up everywhere money is at work.

Exposure Channels

- BanksExposed through their loan books and default risks during catastrophes.

- InvestorsExposed through portfolio volatility and asset devaluation.

- GovernmentsExposed through contingent liabilities and rising disaster relief costs.

What Parametric Insurance Really Does

In traditional insurance, the core question is “How much did you lose?” Answering it requires adjusters and documentation. Parametric insurance asks a different question: “Did the agreed event occur?”

"In a world where a few days of extreme heat or a week of low wind can push a business into cash flow stress, speed and certainty are as valuable as precision."

How InRisk Labs Thinks About Product Design

At InRisk Labs, parametric design does not begin with a model; it begins with a conversation. We translate climate signals into indices that match the human experience of volatility.

Blended indices of temperature and humidity rather than simple thresholds.

Focus on timing and intensity rather than seasonal totals.

Wind speed distributions and hours of sunshine above generation thresholds.

From Analytics to Execution

Even the most elegant parametric structure fails if it cannot be operationalised. A parametric contract only becomes truly useful when it is tied into real distribution and payment channels: cooperatives, microfinance institutions, and state schemes. That is when parametric insurance stops feeling experimental and starts feeling like part of everyday resilience planning.