The Deep Tech Revolution (Part 1): Sensing and Computing Risk

How Quantum AI, IoT, and Hyperspectral Imaging are rebuilding the foundation of parametric insurance.

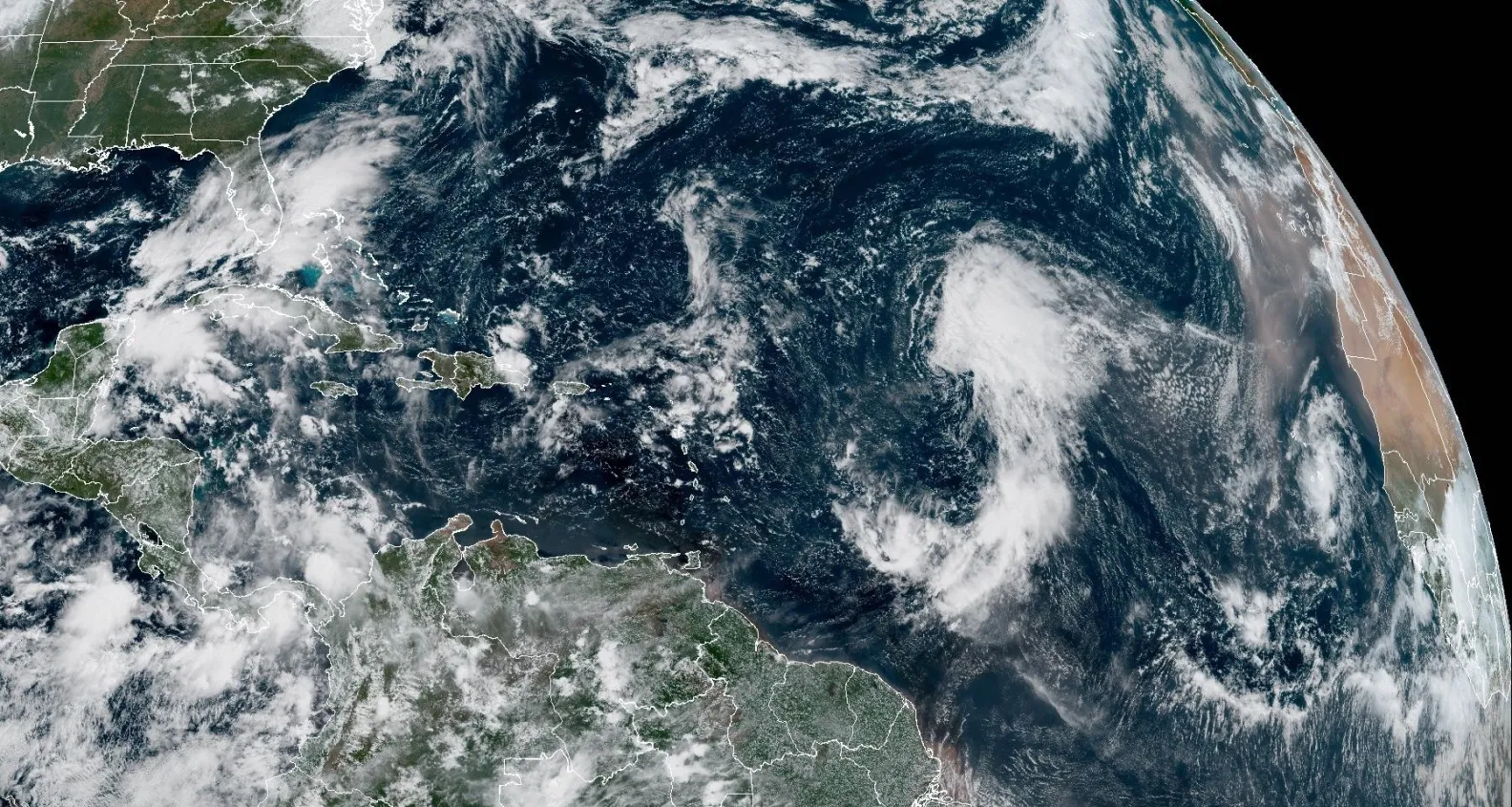

Picture this:A hurricane forms in the Atlantic, thousands of miles away from populated coastlines. Within minutes, quantum-enhanced prediction models running on edge computing infrastructure begin calculating wind patterns with unprecedented precision.

Satellites equipped with hyperspectral imaging already detect subtle atmospheric signals invisible to traditional sensors. As AI models trained on decades of climate data continue to advance, they will increasingly be able to translate these signals into early identification of potential impact zones—creating time and clarity for authorities, insurers, and communities to prepare protective responses well before the storm makes landfall.

"This is not science fiction, but a glimpse of where parametric insurance is headed: a future shaped by the convergence of deep technologies that will transform raw environmental data into faster, more predictable financial protection at global scale."

The Foundation: Real-Time Data Collection Revolution

The cornerstone of parametric insurance lies in its ability to collect, process, and act upon environmental data with surgical precision. This foundational layer represents a technological marvel that spans from space to ground level.

Modern Earth observation satellites have evolved far beyond simple weather monitoring. Advanced satellite platforms equipped with hyperspectral imaging capture data across hundreds of wavelengths invisible to human eyes, detecting everything from soil moisture at different depths to subtle atmospheric pressure changes that precede severe weather events. Insurance Companies leverage these satellite networks to pinpoint local climate metrics with accuracy that enables rapid policy triggers across vast geographic regions.

Distributed IoT devices create a nervous system of environmental intelligence. These sensors, installed on farms, within urban infrastructure, along coastlines, and in river basins, relay granular environmental readings including water height fluctuations, temperature spikes, seismic activity, and soil moisture variations. Advanced sensor arrays now measure dozens of environmental parameters simultaneously.

Technologies like lidar, drone photogrammetry, and continuous flood mapping provide extra precision layers, especially in disaster-prone regions. These systems drastically reduce "basis risk"-the critical gap between parametric triggers and actual losses-by creating real-time digital twins of physical environments.

The Brain: Advanced Analytics and Machine Learning

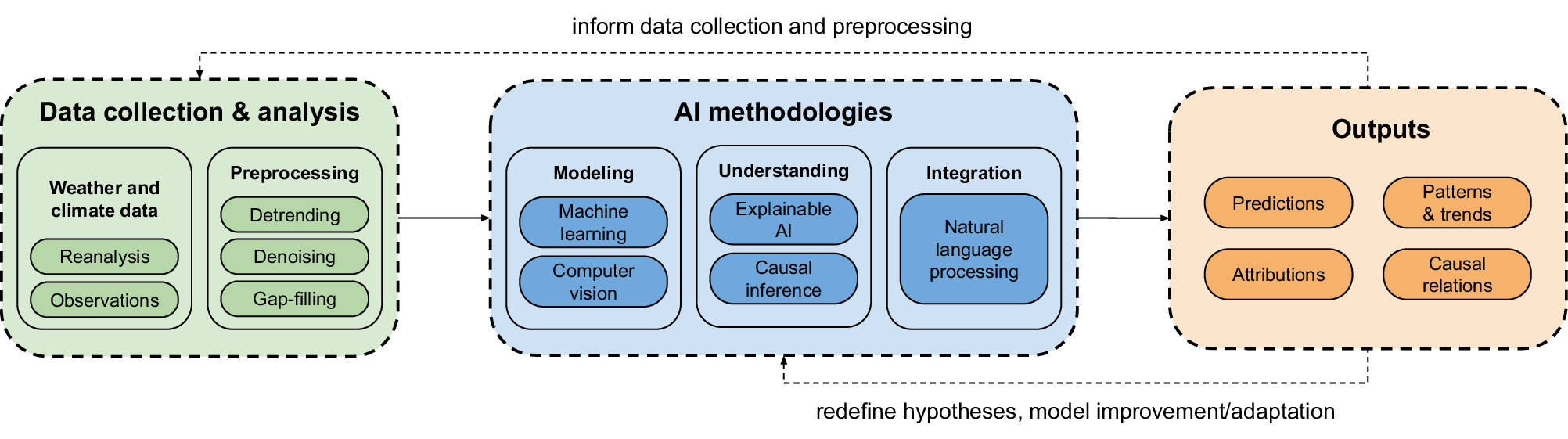

Converting massive environmental datasets into actionable insurance decisions requires sophisticated artificial intelligence architectures that operate at unprecedented speed and accuracy.

- Ensemble AI Modeling: Modern parametric insurance platforms employ collaborative AI systems where multiple models work together-neural networks for pattern detection, reinforcement learning for optimization, and transformer architectures for sequence prediction. These ensemble systems continuously learn from new data, creating robust prediction systems that improve over time.

- Streaming Analytics Platforms: Real-time processing infrastructure using technologies like Apache Kafka, Spark, and AWS Kinesis processes data from sensors and satellites in milliseconds, flagging anomalies against defined policy thresholds. This streaming architecture enables the instant detection of trigger events as they occur.

- Predictive Climate Modeling: Physical simulation systems including numerical weather prediction, regression analyses, and deep neural networks help insurers forecast extreme weather events with mathematical precision. These models don't just react to events-they predict and enable proactive risk mitigation strategies.

The Engine: Quantum Computing and Edge Intelligence

The future of parametric insurance lies in quantum-enhanced computing systems that process the complex variables inherent in risk modeling with exponential speed improvements.

Quantum Risk Modeling

Unlike classical systems that process scenarios sequentially, quantum algorithms evaluate thousands of risk combinations in parallel. This enables financial institutions to model complex interdependencies with computational speeds that were previously impossible.

Edge Computing

Distributed intelligence processes data locally. Edge nodes with AI chips reduce latency from seconds to microseconds. When flood sensors detect rising water, edge infrastructure can initiate payout protocols before central systems even receive the data.

Summary: The Digital Nervous System

We have now established the fundamental layers of the Deep Tech revolution: the "Senses" (Satellites & IoT) and the "Brain" (AI & Quantum Computing). These technologies allow us to witness and understand risk with superhuman speed and accuracy.

But detection is only the first step. To truly transform risk transfer, this intelligence must be connected to an execution layer capable of moving money as fast as the data moves. That is where Blockchain and Smart Contracts take the stage.