The Deep Tech Revolution (Part 2): Execution and Market Growth

From Smart Contracts to Computer Vision: How deep tech automates financial relief and drives market explosion.

Previously in Part 1: We built the foundation-the sensors and computing power that detect risks in real-time. Now, we turn to the Execution layer: the systems that turn that data into instant financial relief.

The Execution: Smart Contracts and Blockchain Automation

The transformation from data detection to financial relief happens through sophisticated blockchain-based automation systems that execute with mathematical precision.

Self-executing contracts automatically trigger payouts when verified data meets predefined conditions, removing human bottlenecks and potential manipulation from financial processes. The global parametric insurance market now sees 48% of insurers using blockchain for secure and automated payouts, with some systems achieving 97.6% accuracy in automated claim processing.

Advanced cryptographic techniques allow verification of data validity without revealing sensitive information, enabling privacy-preserving validation of environmental conditions and personal data. Some advanced frameworks use privacy-preserving cryptography (zk-SNARKs) to validate claims securely without exposing sensitive sensor data on public ledgers.

Digital payment gateways integrating with banks, mobile wallets, and digital cash platforms deliver payouts to policyholders within hours-sometimes minutes-once trigger events are confirmed. This automation shrinks response times from weeks to near-instantaneous relief.

The Vision: Computer Vision and Damage Assessment

Advanced computer vision systems have evolved beyond simple image recognition to sophisticated damage assessment capabilities that rival human expertise, revolutionizing how insurers evaluate and respond to catastrophic events.

Hyperspectral Analysis

Advanced imaging systems capture data across hundreds of wavelengths invisible to human eyes, detecting structural damage, moisture intrusion, and material degradation. These systems analyze damage with 80-95% accuracy.

Multi-Modal Fusion

Computer vision systems combine optical imagery with thermal, LIDAR, and radar data to create comprehensive damage assessments. Convolutional neural networks can classify severity and estimate repair costs with superhuman accuracy.

Market Dynamics: The Explosive Growth Story

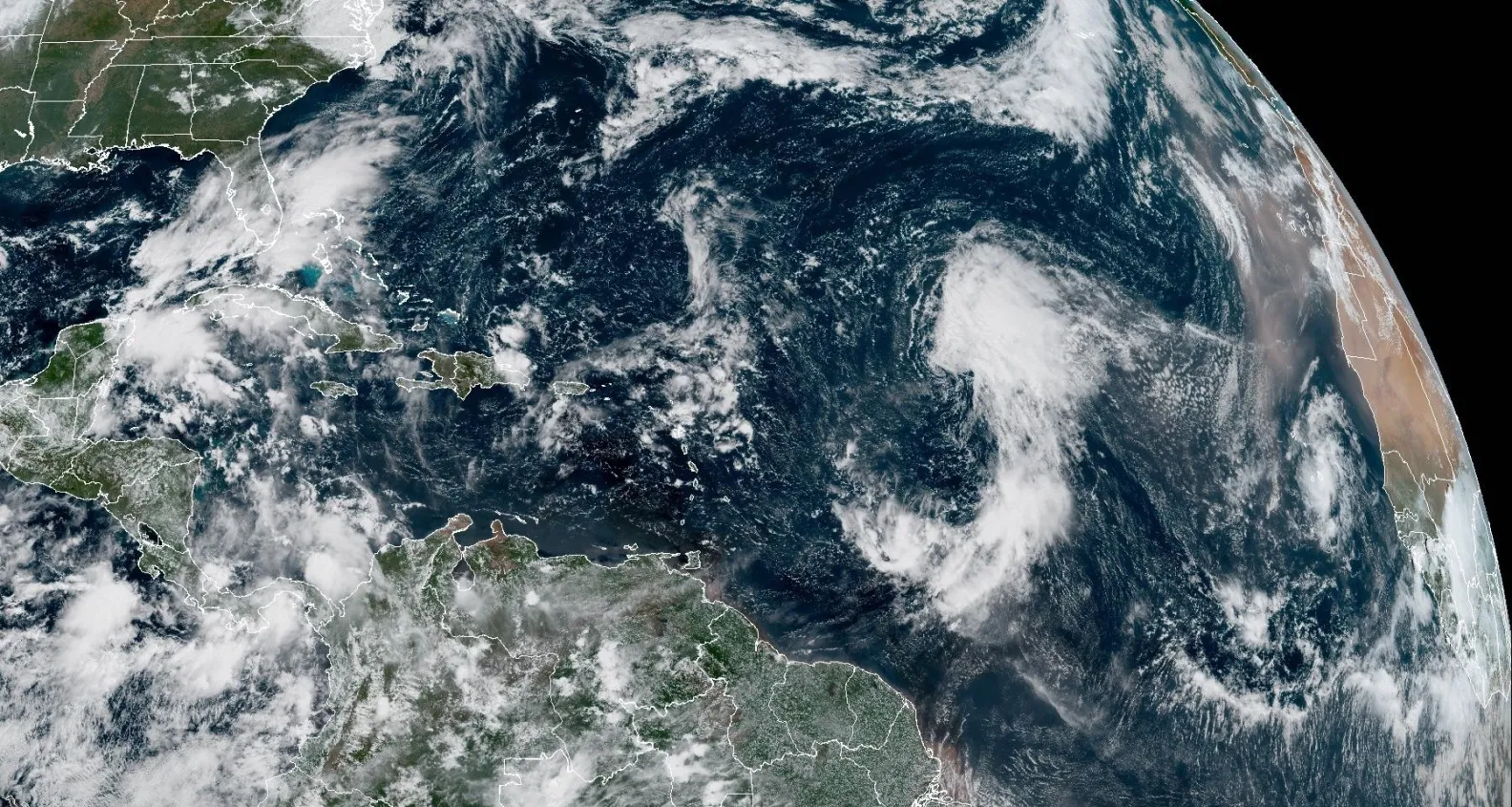

The parametric insurance market is experiencing unprecedented growth, driven by technological advancement and increasing climate volatility.

"Global parametric insurance premiums reached $15.1 billion in 2025, growing at an annual rate of 19.8%. The market is projected to reach $47.8 billion by 2035."

- Sector Leadership: Natural catastrophe insurance holds 57% of total market share, while agriculture represents 28%. The construction industry posts the fastest growth at10.8% CAGR.

- Technological Investment: Insurtech investment in parametric insurance reached$1.6 billion in 2025, up 23% year-over-year. IoT-driven parametric policies are up 33% annually.

Real-World Applications: Innovation in Action

Leading companies are demonstrating the transformative potential of deep tech parametric solutions:

FloodFlash uses IoT water level sensors for rapid flood loss assessment and payouts in hours, exemplifying how sensor networks enable instant claims processing.

Arbol offers climate and agricultural parametric covers powered by AI models, blockchain, and real-time weather feeds, showing how multiple technologies integrate seamlessly.

Descartes Underwriting builds catastrophe insurance using satellite imagery and AI-driven risk modeling for global businesses, automating detection and payout.

The Convergence Effect

The true revolutionary power emerges when these technologies work in concert. Quantum computers optimize AI model training while edge devices run computer vision algorithms locally. Blockchain networks automate financial mechanisms as IoT sensors feed real-time data to machine learning systems. This technological convergence creates capabilities that exceed the sum of individual parts.

Conclusion: The Future of Risk Management

Parametric insurance represents more than technological innovation-it embodies a fundamental shift toward data-driven, automated financial protection that operates at the speed of natural disasters themselves. Through the convergence of quantum computing, AI, IoT, blockchain, computer vision, and edge computing, parametric insurance transforms the chaos of environmental volatility into predictable, programmable financial mechanisms.

As climate change accelerates and global risks multiply, this deep tech revolution ensures that when catastrophe strikes, relief doesn't depend on paperwork, adjusters, or bureaucratic delays. It depends on data, algorithms, and automated systems that move as fast as the storms themselves-delivering financial safety when it's needed most, measured in minutes rather than months.

The future isn't just insured-it's parametrically protected by the most advanced technologies humanity has ever deployed.