The Death of the PDF: Moving Insurance from Documents to Data Streams

From Proof of Loss to Proof of Event: Why the Future of Indian Risk Protection is Written in Data, Not Documents

The insurance industry frequently speaks about digital transformation. In practice, however, much of the system remains anchored in outdated workflows. Paper forms were scanned, converted into PDFs, and labeled “digital.” The underlying process did not change.

This approach has created a structural bottleneck. A PDF is a static container of information that cannot be verified, audited, or acted upon without human intervention. When disasters occur—such as floods in Chennai, cyclones along the Odisha coast, or heatwaves across northern India—the recovery process does not begin with financial support. It begins with locating documents, many of which no longer exist.

This dependency on PDFs has become one of the most significant barriers to effective risk protection in India.

1. The Bottleneck: Why Digitized Is Not Digital

Traditional insurance operates on proof of loss. Policyholders must demonstrate what was damaged or lost through invoices, tax filings, inventory records, and site photographs.In India, this model is especially fragile. Small businesses, informal enterprises, farmers, and self-employed workers often maintain records in physical form or on personal devices. During disasters, these records are frequently destroyed. Even when documents survive, the claims process is slow.

Verification depends on manual review by adjusters, resulting in significant delays. For catastrophe-related claims, settlement timelines often stretch into months. During this period, businesses remain closed, farmers miss planting cycles, and households rely on debt to manage basic expenses. PDF-based systems are inherently limited. They do not integrate with other systems, cannot be validated in real time, and require human interpretation at every step. This creates cost, delay, and uncertainty precisely when speed is critical.

2. From Proof of Loss to Proof of Event

A fundamentally different approach is now emerging. Parametric insurance replaces proof of loss with proof of event. Instead of assessing damage after it occurs, payouts are triggered automatically when a predefined, measurable event takes place.

For example, if wind speeds exceed a specified threshold in a defined geographic location, or rainfall crosses a critical level during a crop cycle, the insurance contract is activated automatically. No claims forms are required. No documents need to be submitted.

The policy functions as a live connection to the physical world, continuously linked to trusted data sources. When the event occurs, the payout process begins immediately. This shift moves insurance from a reactive system to a proactive one.

3. Public Data as a Shared Source of Truth

Trust in data is central to this model. In the traditional system, insurers controlled the interpretation of documents, often leading to disputes and prolonged negotiations. Parametric insurance reduces this friction by relying on public and open datasets that are accessible to all parties simultaneously.

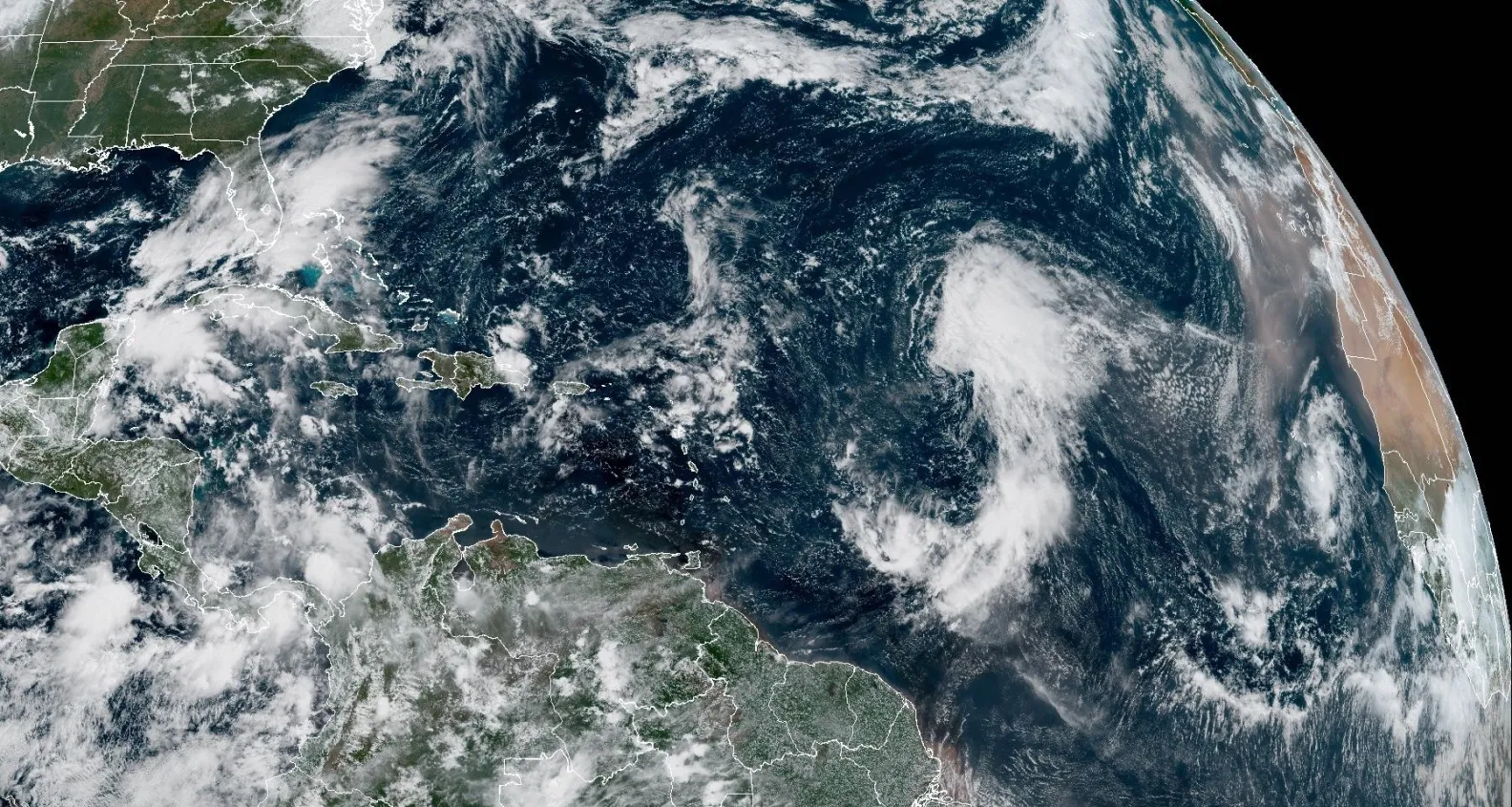

In the Indian context, these datasets include satellite imagery from global agencies such as NASA and ESA, and weather data from the India Meteorological Department (IMD). Radar satellites can now map floods, even during heavy cloud cover and at night.

Verified Data Streams include:

- •IMD Weather Data

- •ERA5 Climate Reanalysis

- •NASA IMERG Rainfall

- •JAXA GSMaP Mapping

- •USGS Seismic Data

- •IBTrACS Cyclone Tracking

- •MODIS Environmental Sensors

- •Copernicus Sentinel Series

Because these sources are independent and transparent, both insurers and policyholders rely on the same information. This shared visibility removes uncertainty and reduces disputes. When the data confirms that an event occurred, the outcome is clear.

4. Near Real-Time Payouts and Economic Resilience

In India, speed of payout has direct economic consequences. The first few days after a disaster often determine whether a small business reopens, a farmer replants, or a household avoids high-interest borrowing. Delayed payouts—sometimes extending beyond 200–300 days—offer limited practical value.

Data-driven insurance significantly reduces this delay. When payouts are triggered by verified data streams, settlement can occur within days, or even hours. This timely capital is not merely compensation; it is a tool for resilience.

This data-driven approach enables:

- •Farmers to purchase inputs for the next sowing cycle

- •Micro and small enterprises to repair equipment immediately

- •Renewable energy operators to manage production losses

- •Informal workers to stabilize income after extreme weather

Conclusion: Engineering Certainty in Insurance

The transition from PDFs to data streams is not a technology upgrade—it is a structural correction. Insurance systems built on static documents are opaque, slow, and vulnerable to failure during crises. Systems built on transparent, real-time data create certainty, reduce friction, and restore trust.

As climate risks intensify across India, the insurance sector must evolve from document-driven verification to data-driven automation. The decline of the PDF marks the emergence of an insurance model designed to function under real-world stress.

"When truth is established through data, support is no longer delayed by paperwork. The signal is clear, and assistance can arrive when it is needed most."