The Unblinking Eye: Building an Insurance System with No Human Bias

Moving from a world where the insurer decides what is true, to a world where Global Data Oracles act as the ultimate, unbiased referees.

In my previous post, we looked at the "Time Tax"—the devastating 300-day lag that turned a manageable loss in Idukki into a terminal debt crisis. We saw how the "Adjuster’s Clipboard" failed because human surveyors couldn't move as fast as the water rose, and vital documentation was swallowed by the mud.

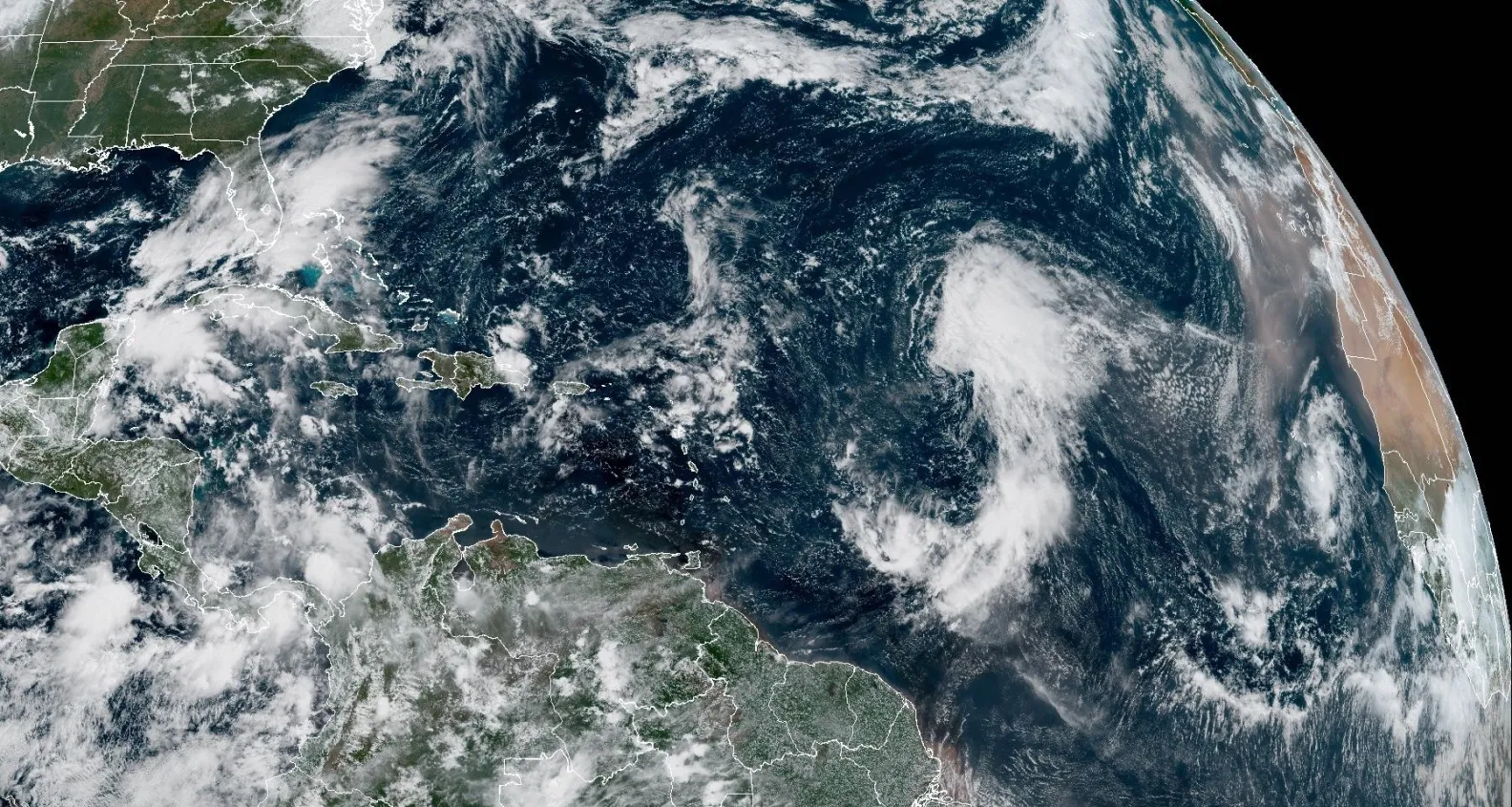

But what if the "Referee" was already there, watching from 500km above and measuring from the soil below? In 2026, the insurance industry is undergoing a "Copernican Revolution." We are moving away from a world where the insurer decides what is true, to a world where Global Data Oracles act as the ultimate, unbiased referees.

What is an Insurance Oracle?

In the traditional insurance model, a claim is a negotiation. You argue your loss; the adjuster minimizes it. It is an adversarial process where the person holding the check also holds the power. In the parametric model, a claim is a logic statement:

THEN [Smart Contract] triggers 100% payout.

An "Oracle" is the digital bridge. It is a secure, third-party data feed that connects a physical event (the rainfall, the earthquake magnitude, the wind speed) to a financial contract. It eliminates "Human Bias" because the data is the judge, jury, and executioner of the claim. There is no "opinion" involved—only the physics of the event.

The Hierarchy of Truth: The "Triple-Lock" of the Global Grid

To build a system with no surveyors, we must eliminate Basis Risk—the fear that the data recorded by a sensor doesn't match the reality on the ground. To solve this, the global insurance landscape is moving toward a "Triple-Lock" of verification.

I. The Sky: Synthetic Aperture Radar (SAR)

Optical satellites (like Google Earth) are blinded by clouds—the very thing that causes floods and hurricanes. SAR has changed the game.

II. The Ground: The Global IoT Mesh

Satellites provide the macro-view, but ground-level sensors provide the "Micro-Truth." Automated weather stations (AWS) and IoT soil sensors are being networked globally.

III. The Consensus: Decentralized Oracle Networks (DONs)

To ensure the insurer hasn't "fixed" the data, we use Decentralized Oracles to verify events through consensus.